Senior Housing: The Next Frontier of Commercial Real Estate

Why seasoned CRE investors are turning to the demographic engine driving America’s most resilient real-estate opportunity.

For multifamily, industrial, retail, and office investors evaluating senior housing

Executive Summary

Across every property type—multifamily, retail, industrial, and office—one fundamental truth remains: growth follows jobs. But for investors evaluating their next horizon, there is a second driver that is even more predictable, durable, and data-anchored: aging.

The U.S. population aged 75 and older is expanding faster than any other age cohort. At the same time, America’s top employment markets—Austin, Dallas–Fort Worth, Orlando, Phoenix, Tampa, and others—are expanding their economic bases through technology, healthcare, logistics, and advanced manufacturing.

The intersection of employment vitality and demographic inevitability creates a long-term demand case that many diversified CRE investors have not fully priced in: senior housing.

The U.S. population aged 75 and older is expanding faster than any other age cohort. At the same time, America’s top employment markets—Austin, Dallas–Fort Worth, Orlando, Phoenix, Tampa, and others—are expanding their economic bases through technology, healthcare, logistics, and advanced manufacturing.

The intersection of employment vitality and demographic inevitability creates a long-term demand case that many diversified CRE investors have not fully priced in: senior housing.

Job Growth: The Demand Engine Behind All CRE

A market that is adding jobs is a market that is adding tenants, customers, and value. Employment growth fuels absorption, stabilizes vacancy, and supports rent growth across traditional CRE. That’s why the 2026 forecasts calling for:

For multifamily, retail, and industrial investors, this is familiar: new jobs = new households, more spending, and more goods movement.

- Austin – projected to lead the nation in percentage growth, adding 34,000 jobs (2.5%) driven by tech and advanced manufacturing.

- Orlando – 31,000 jobs (2.0%), diversifying beyond tourism into aerospace, biotech, and simulation.

- Phoenix – 50,000 jobs (1.9%), powered by a semiconductor resurgence (TSMC, Intel).

- Dallas–Fort Worth – 85,500 jobs, 1.8%, the volume leader with unmatched diversification.

- Tampa, Charlotte, Nashville, Miami–Fort Lauderdale, Atlanta, Las Vegas – all in the 1.7–1.8% range, notably above pre-pandemic baselines.

For multifamily, retail, and industrial investors, this is familiar: new jobs = new households, more spending, and more goods movement.

The 75+ Population: The Demographic Tailwind CRE Can’t Ignore

Unlike cyclical job growth, aging is linear and highly predictable. U.S. data shows:

That means even investors who have maximized multifamily in high-growth metros can unlock a second, needs-based demand curve by adding senior housing to the mix.

- The 75+ cohort is set to grow sharply through 2035.

- Sunbelt states (FL, AZ, TX, NV) get a double boost: natural aging + retiree in-migration.

- Florida’s west coast, Phoenix/Maricopa, and Las Vegas/Clark County will see some of the fastest senior-household formation.

That means even investors who have maximized multifamily in high-growth metros can unlock a second, needs-based demand curve by adding senior housing to the mix.

Where Job Growth and Senior Growth Converge

The most attractive markets are those that score high on both axes — strong 2026 employment forecasts and accelerating 65+/75+ growth. Examples:

- Orlando: jobs diversifying + 62% projected 65+ growth → ideal for IL/AL/active adult.

- Phoenix (Maricopa): semiconductor-led job creation + one of the nation’s largest senior bases.

- Tampa & Miami–Fort Lauderdale: already senior-heavy, now adding higher-wage jobs.

- Las Vegas: jobs normalizing while 65+ share rises toward 20% → excellent senior-housing runway.

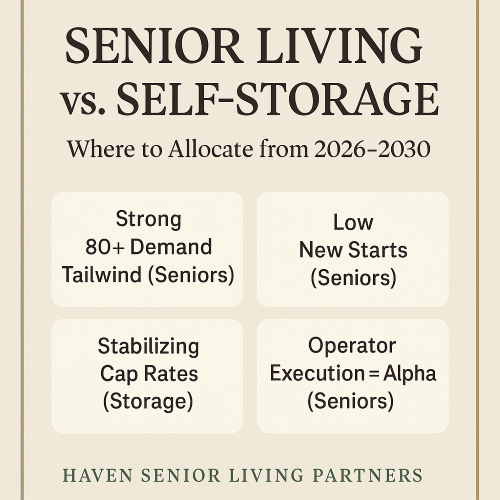

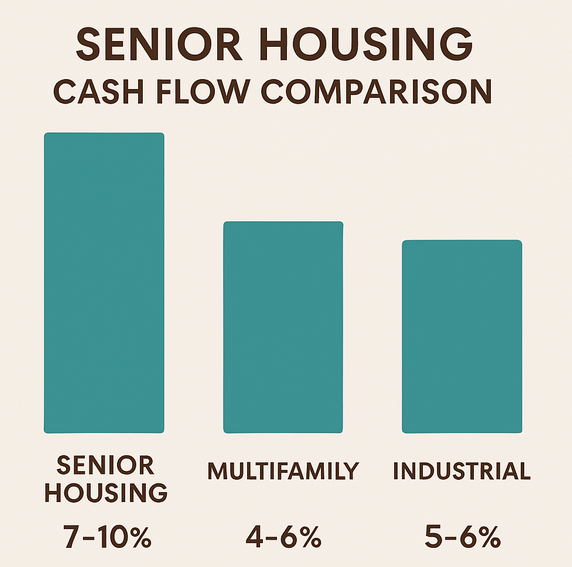

Senior Housing vs. Other CRE Asset Classes

Most investors reading this have allocations to multifamily, industrial, or necessity retail. Senior housing offers:

- A demographic demand base instead of a purely economic one.

- Cap rates/yields 75–150 bps above multifamily in many 2025-26 deals.

- Defensive cash flow tied to aging and care needs.

How Diversified CRE Investors Should Enter

Core / Core-Plus: Target stabilized IL/AL in senior-heavy Sunbelt metros.

Value-Add: Reposition under-managed assets; layer in stronger regional operators.

Development / OZ: In metros where 75+ growth clearly outpaces current inventory.

Co-GP / JV: Best starting point for multifamily or industrial owners that want senior exposure but not the day-to-day operating complexity.

Value-Add: Reposition under-managed assets; layer in stronger regional operators.

Development / OZ: In metros where 75+ growth clearly outpaces current inventory.

Co-GP / JV: Best starting point for multifamily or industrial owners that want senior exposure but not the day-to-day operating complexity.

Ready to add a demographic engine to your CRE portfolio?

Haven Senior Living Partners identifies, structures, and manages senior housing opportunities

in metros where job growth and aging intersect.

Share this to:

Facebook

LinkedIn

Email

WhatsApp

Threads

X