How Bonus Depreciation Turns a $20M Senior Housing Project into a Tax‑Smart Investment

We’re developing a $20M apartment community with $8M of investor equity. In Year 1, investors are projected to receive $5M+ in bonus depreciation—a paper loss equal to roughly 65% of initial capital. Below is how it works and the "super‑move" that can make those tax savings permanent.

How Bonus Depreciation Works

Residential buildings are normally depreciated over 27.5 years. A Cost Segregation Study separates components with shorter lives (appliances, flooring, HVAC, parking lot, landscaping). The result: decades of deductions are accelerated into Year 1 via bonus depreciation.

Who Can Use These Losses?

- Passive investors: May use deductions to offset other passive income (e.g., other rentals or partnership K‑1s).

- Real Estate Professionals (REPs): May offset all income, including W‑2 or active business income.

If losses exceed current‑year income, unused losses carry forward to future years.

The Catch: Depreciation Recapture

Large deductions aren’t a permanent free lunch. Upon sale, the IRS can recapture depreciation and tax it at rates up to 25%. Smart planning can minimize—or even eliminate—this.

Two Paths at Exit: Deferral vs. Elimination

Path #1: 1031 Exchange (Deferral)

- Sell the property and roll proceeds into a new one within strict timelines.

- Defers both capital gains and depreciation recapture.

- Downside: you’re kicking the can—and execution must be precise.

Path #2: Opportunity Zone (Elimination)

- Structure within an Opportunity Zone (OZ) fund from day one and hold 10+ years.

- No capital gains tax on sale.

- No depreciation recapture.

Result: that upfront $5M bonus depreciation becomes a permanent, tax‑free benefit. This is the exact structure used in our current $20M project.

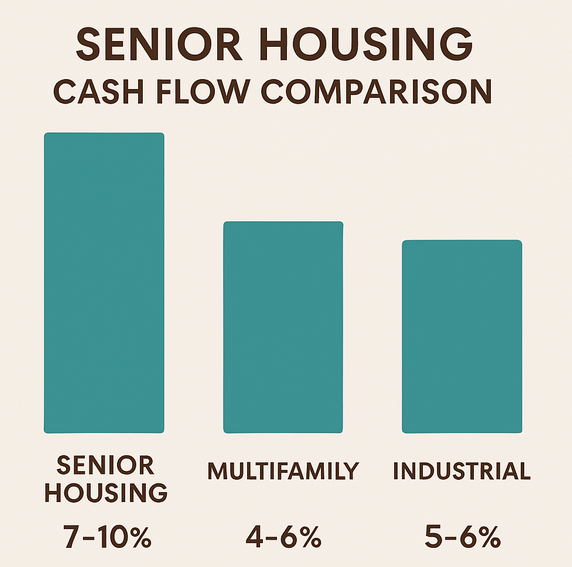

Why After‑Tax Returns Matter

Pre‑tax IRR and cash‑on‑cash only tell half the story. When you combine bonus depreciation up front, steady cash flow during the hold, and tax elimination at exit via OZ, you transform a solid deal into a tax‑optimized wealth engine.

Investor & CPA Question

When you underwrite a deal, how much weight do you place on after‑tax outcomes like bonus depreciation and the exit strategy? We’d love your perspective.