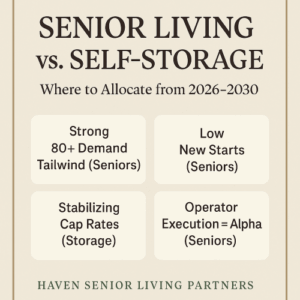

Mapping Liquidity Red Flags → Senior Housing & OZ Capital Timing

Market Intelligence Mapping Liquidity Red Flags → Senior Housing & OZ Capital Timing A decision-oriented framework linking today’s liquidity signals to senior housing execution risk and Opportunity Zone capital pacing